Some Known Incorrect Statements About Stonewell Bookkeeping

Wiki Article

Indicators on Stonewell Bookkeeping You Should Know

Table of ContentsWhat Does Stonewell Bookkeeping Mean?Stonewell Bookkeeping Can Be Fun For EveryoneWhat Does Stonewell Bookkeeping Do?An Unbiased View of Stonewell BookkeepingStonewell Bookkeeping for Beginners

As opposed to experiencing a filing cupboard of various files, invoices, and invoices, you can offer detailed documents to your accounting professional. In turn, you and your accounting professional can conserve time. As an added incentive, you might even be able to determine prospective tax write-offs. After utilizing your audit to submit your taxes, the IRS may select to do an audit.

That funding can can be found in the form of owner's equity, grants, organization lendings, and investors. But, capitalists require to have a good idea of your company before investing. If you do not have audit records, financiers can not identify the success or failing of your business. They need up-to-date, exact details. And, that details requires to be easily easily accessible.

Stonewell Bookkeeping - Questions

This is not meant as legal suggestions; for additional information, please visit this site..

We addressed, "well, in order to know exactly how much you require to be paying, we require to understand exactly how much you're making. What is your net earnings? "Well, I have $179,000 in my account, so I presume my web income (profits much less costs) is $18K".

Stonewell Bookkeeping - An Overview

While maybe that they have $18K in the account (and even that may not hold true), your equilibrium in the financial institution does not necessarily determine your revenue. If somebody obtained a give or a funding, those funds are ruled out revenue. And they would not infiltrate your earnings statement in identifying your revenues.

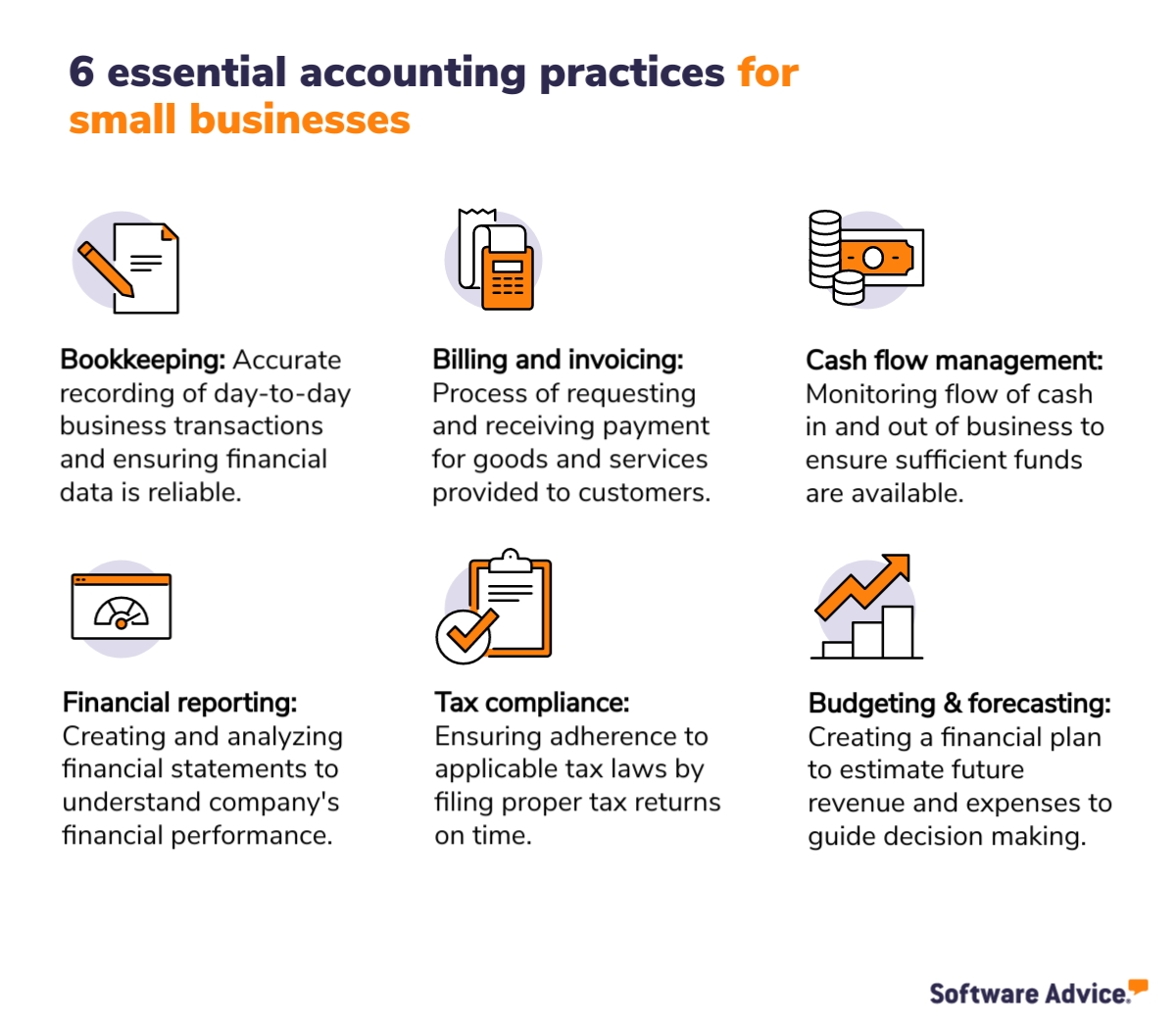

While maybe that they have $18K in the account (and even that may not hold true), your equilibrium in the financial institution does not necessarily determine your revenue. If somebody obtained a give or a funding, those funds are ruled out revenue. And they would not infiltrate your earnings statement in identifying your revenues.Numerous points that you assume are expenditures and deductions are in fact neither. An appropriate collection of publications, and an outsourced accountant that can properly classify those deals, site here will assist you determine what your organization is actually making. Accounting is the process of recording, identifying, and arranging a business's financial purchases and tax obligation filings.

A successful organization requires help from professionals. With practical goals and a competent accountant, you can quickly address obstacles and keep those concerns away. We're right here to help. Leichter Accounting Services is an experienced certified public accountant company with an enthusiasm for bookkeeping and dedication to our clients - small business bookkeeping services (https://writeablog.net/hirestonewell/rqhr1mxsuw). We commit our power to guaranteeing you have a solid monetary structure for development.

The Only Guide for Stonewell Bookkeeping

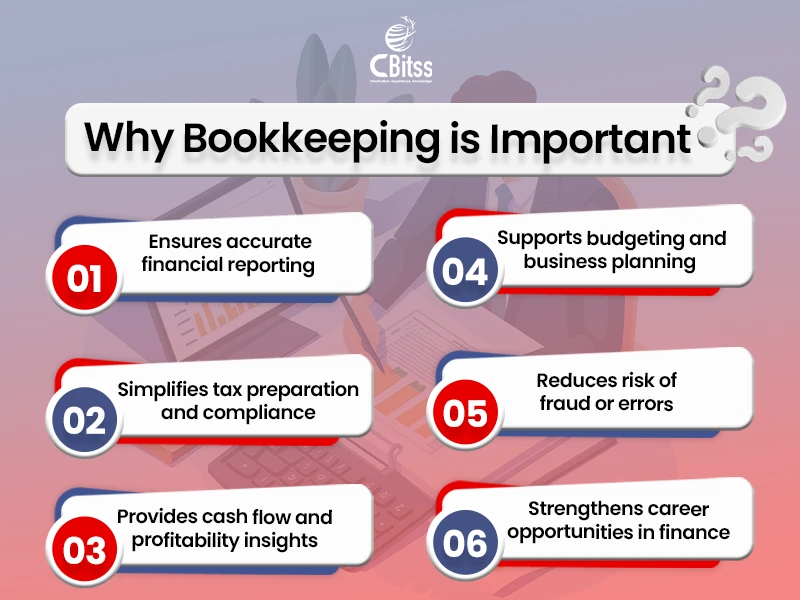

Exact bookkeeping is the backbone of good economic management in any type of business. It aids track income and costs, ensuring every deal is videotaped appropriately. With great bookkeeping, businesses can make far better choices since clear financial documents use important data that can guide approach and enhance earnings. This info is key for lasting preparation and forecasting.On the other hand, strong accounting makes it simpler to secure financing. Accurate monetary declarations build trust fund with lenders and capitalists, enhancing your opportunities of getting the funding you require to grow. To preserve solid financial health and wellness, organizations should routinely integrate their accounts. This means matching deals with financial institution statements to catch errors and stay clear of financial inconsistencies.

They assure on-time settlement of bills and quick consumer negotiation of billings. This improves cash flow and aids to prevent late penalties. A bookkeeper will go across bank declarations with internal documents a minimum of once a month to find mistakes or inconsistencies. Called bank reconciliation, this process guarantees that the financial records of the company suit those of the bank.

They keep track of current payroll information, subtract taxes, and figure pay ranges. Accountants produce basic financial records, including: Profit and Loss Declarations Reveals profits, costs, and net profit. Annual report Provides possessions, obligations, and equity. Capital Declarations Tracks cash activity in and out of business (https://hirestonewell.start.page). These reports assist organization proprietors understand their financial setting and make informed decisions.

Top Guidelines Of Stonewell Bookkeeping

The most effective selection depends upon your budget plan and service requirements. Some local business owners favor to handle accounting themselves making use of software program. While this is economical, it can be taxing and prone to errors. Devices like copyright, Xero, and FreshBooks enable company owner to automate bookkeeping tasks. These programs aid with invoicing, bank settlement, and monetary reporting.

Report this wiki page